- Location: The location of your home is one of the most significant factors in determining your insurance rates. If you live in an area that is prone to natural disasters like hurricanes, earthquakes, or floods, you may have to pay higher insurance premiums.

- Home value and construction: The cost of rebuilding or repairing your home in case of damage is a critical factor in determining your insurance rates. Homes made of expensive materials or those with intricate designs may cost more to repair, and therefore have higher premiums.

- Age of the home: The age of your home can also impact your insurance rates. Older homes may require more repairs and maintenance, making them more expensive to insure.

- Type of dwelling: The type of dwelling you have, such as a single-family home, condo, or townhouse, can also affect your insurance rates.

- Claims history: Your claims history can also impact your insurance rates. If you have filed multiple claims in the past, insurance companies may consider you a higher risk and charge higher premiums.

- Credit score: Your credit score can also be a factor in determining your insurance rates. Insurance companies often use credit scores to determine how likely you are to file a claim.

- Deductible amount: The amount of your deductible can also impact your insurance rates. A higher deductible can lower your premiums, but it also means you'll have to pay more out of pocket if you do file a claim.

- Security features: Insurance companies may offer lower rates to homeowners who have security features installed in their homes, such as alarm systems, security cameras, and smoke detectors.

- Occupancy: Whether or not you occupy your home can also be a factor in determining your insurance rates. A vacant home may be considered a higher risk than one that is occupied.

- Liability coverage: Your liability coverage, which protects you if someone is injured on your property, can also affect your insurance rates. Higher coverage limits may result in higher premiums.

Friday, April 28, 2023

10 Factors that Affect Your Home Insurance Rate

Thursday, April 27, 2023

Uninsured Motorist Coverage - Why You Need It

Being involved in a car accident can be a stressful and frightening experience, but it can be even more challenging if the other driver doesn't have insurance or doesn't have enough insurance to cover the damages. That's where uninsured motorist coverage comes in. In this blog post, we'll explore what uninsured motorist coverage is, why you need it, and how it works.

What is uninsured motorist coverage?

Uninsured motorist coverage is a type of insurance that provides protection for you and your passengers in the event of an accident with an uninsured or underinsured driver. This coverage is designed to pay for damages and injuries that are not covered by the other driver's insurance policy.

There are two types of uninsured motorist coverage:

Uninsured motorist bodily injury (UMBI): This coverage pays for medical expenses, lost wages, and other damages if you or your passengers are injured in an accident with an uninsured or underinsured driver.

Uninsured motorist property damage (UMPD): This coverage pays for damages to your vehicle or other property caused by an uninsured or underinsured driver.

Why do you need uninsured motorist coverage?

While car insurance is required by law in most states, not everyone follows the law. According to a report by the Insurance Information Institute, approximately 13% of drivers in the United States were uninsured in 2015. If you're involved in an accident with an uninsured driver, you may be responsible for paying for damages out of pocket.

Even if the other driver has insurance, their policy may not provide enough coverage to pay for all the damages. In this case, uninsured motorist coverage can help cover the difference.

How does uninsured motorist coverage work?

If you're involved in an accident with an uninsured or underinsured driver, you'll need to file a claim with your insurance company. Your insurance company will then investigate the claim and determine the amount of damages you're entitled to.

If the other driver is found to be at fault and uninsured, your insurance company will pay for the damages up to the policy limits. If the damages exceed the policy limits, you may be responsible for paying the remaining balance.

It's important to note that uninsured motorist coverage is not a replacement for liability insurance. Liability insurance is designed to protect other drivers and their property in the event that you're at fault for an accident. Uninsured motorist coverage is designed to protect you and your passengers in the event of an accident with an uninsured or underinsured driver.

In conclusion, uninsured motorist coverage is an essential type of insurance that can provide peace of mind knowing that you're protected in the event of an accident with an uninsured or underinsured driver. If you're considering purchasing this coverage, reach out to one of our insurance agents at Community Insurance Solutions to understand the coverage options available to you and to determine if this coverage is right for you.

Friday, April 14, 2023

Distracted Driving

Distracted driving is a serious problem that has been on the rise in recent years. In 2022, there were an estimated 3,142 people killed in motor vehicle crashes involving distracted drivers. This represents a 10% increase from the previous year.

There are many different types of distractions that can lead to accidents, including:

- Texting and driving

- Talking on the phone

- Eating or drinking

- Adjusting the radio or other controls

- Talking to passengers

- Looking at other vehicles or objects

- Daydreaming or being lost in thought

Any of these distractions can take your eyes off the road, your hands off the wheel, or your mind off of driving. This can lead to a crash, even if you are only distracted for a few seconds.

The National Highway Traffic Safety Administration (NHTSA) has been working to raise awareness of the dangers of distracted driving. In 2019, the NHTSA launched a new campaign called "Don't Drive Distracted. It Can Wait." The campaign features public service announcements, social media posts, and other materials that educate drivers about the dangers of distracted driving.

The NHTSA also works to enforce distracted driving laws. In 2022, law enforcement officers across the country issued more than 4 million tickets for distracted driving. These tickets can result in fines, points on your driver's license, and even jail time.

If you are caught driving distracted, you could face serious consequences. In addition to the legal penalties, you could also be held liable for any injuries or property damage that results from a crash.

It is important to remember that distracted driving is not worth the risk. If you need to take your eyes off the road, pull over to a safe location. It is not worth risking your life or the lives of others.

Here are some tips for avoiding distracted driving:

- Put your phone away. Turn it off, put it in the glove compartment, or use a hands-free device.

- Don't eat or drink while driving.

- Avoid talking to passengers about anything that is not essential to driving.

- Make sure your car is in good working order so you don't have to fiddle with the controls while driving.

- Take breaks from driving if you are feeling tired or drowsy.

- If you have to take medication that makes you drowsy, don't drive.

- If you are going to be driving for a long time, plan ahead and make sure you have a way to stay awake and alert.

By following these tips, you can help to make the roads safer for everyone.

Go to Community Insurance Solutions' website for a car insurance quote today.

Wednesday, April 5, 2023

Boating Essentials

Whether you're a sailor who's going out to sea on a pontoon, speed boat, or sailboat, there's something special about being behind the wheel, cutting through the waves. However, we don't want your day to be ruined by forgetting the most essential items needed for your trip out at sea.

- PFD (Personal Flotation Device or Life Jacket):

You will need at least one PFD for each person on board. Children under 13 are often required by law to wear a flotation device while on a boat. See what your state has to say about these PFD requirements. - Whistle:

Blow on the whistle while wet to make sure it still works through the water! - Water:

No matter how long you intend to stay out, bring a full supply of water for each sailor on board to ensure that you'll have access to clean water in case of the unexpected. - First Aid Kit:

You never know what the waves will bring while out boating. Make sure you always have a stocked first aid kit on board to tend to the small accidents as well as the big.

Tuesday, March 21, 2023

Gap Insurance

What is gap insurance?

Gap insurance (or auto loan/lease coverage) is an additional coverage you can add to your car insurance policy. It covers the remaining loan or lease amount you may have on your vehicle if it’s totaled in a covered accident.

So, if your car is damaged in an accident and your insurance company deems it a total loss, your insurance company will pay off your remaining loan balance rather than just the current value of your vehicle considering age, condition and mileage. This loss of value over time is called depreciation.Without this coverage, you would be responsible for the “gap” (hence its name) between what’s left on your loan and your vehicle’s current, depreciated value.

For example, if your vehicle is totaled in a covered accident, your insurance company will provide you with a claim payout equal to your vehicle’s depreciated value (less any deductible). Depending on the amount of your loan and the depreciation on your specific vehicle, the amount your insurance company pays you may be less than the amount left on your loan. This leaves you having to pay that remaining amount. However, with gap insurance, your insurance company would pay the remaining loan amount.

Example of how gap insurance works

Let’s say your car is totaled after a bad accident. Your car’s current value is $10,000.

You have a loan on this vehicle. Your remaining loan amount is $12,000.

Your insurance company is going to pay you the current value of your car ($10,000).

This leaves a remaining $2,000 balance on your loan, which you will need to pay. If you have auto loan/lease coverage, it may pay the remaining $2,000 for you.

What is the most gap insurance will pay?

In general, your insurance will pay the lender based on what you owe on your vehicle and the coverages your policy has, but this can vary depending on your claim.

Who may need gap insurance?

If you either took out a loan to pay for your vehicle or it’s under a lease, you may want to consider gap insurance.

Other factors that may influence your decision include:

- The amount of principal left on your loan

- The age of the vehicle

- Your personal financial situation

Where do I buy gap insurance?

To buy gap insurance, you’ll likely need to have a car insurance policy that includes the comprehensive (other than collision) and collision coverages. Most companies will require you have both of these coverages on your vehicle’s policy before they will add an auto loan/lease gap coverage.

We, of course, think that contacting Community Insurance Solutions LLC is the best first step. Car dealerships do offer gap insurance, but it’s often more expensive than just adding it to your existing car insurance policy.

Learn more at Community Insurance Solutions LLC.

Wednesday, March 15, 2023

Why did My Car Insurance Premium Go Up?

If you opened your car insurance bill recently and noticed it’s higher than you expected, you’re likely experiencing the insurance rate increases being made by most insurance companies in late 2022 and into 2023. Insurance companies are raising their rates in response to significant changes in the marketplace.

Why did my car insurance go up?

Several unprecedented changes are driving up car insurance rates, the first being the increased costs of a car insurance claim. This increased claim cost is largely due to:

- Increased severity of car insurance claims

- Price increases for replacement parts

- Availability of replacement parts

- Repair shops are short-staffed

- Repairs are taking longer, which increases the total cost to rent a vehicle since you may need it longer

There is also a shortage of new and used vehicles. Because of these shortages, the prices to replace a vehicle have significantly increased, making claims for totaled cars much more expensive.

Of course, we can’t forget inflation. Just like many other industries right now, inflation is driving up prices.

How much can I expect my car insurance to go up?

The amount that your car insurance will increase varies by state and depends on your policy. There is no set percentage that all insurance companies are increasing. The adjustment is based on the price increases they’ve seen in their claims and adjustments for inflation. All rate changes also have to be approved by your state’s department of insurance.

What if I didn’t file any claims?

Filing a claim can affect your rates. However, this particular rate increase is usually going to be more heavily motivated by the drastic changes in the marketplace.

Should I switch my insurance?

Seeing your rate increase may prompt the question of switching insurance companies. Since this is a change affecting the entire insurance industry, rates may not be that much different. However, it never hurts to check.

Community Insurance Solutions LLC is a great resource and can help you compare quotes from multiple insurance companies to find the coverage and rate best for you.

Tuesday, March 14, 2023

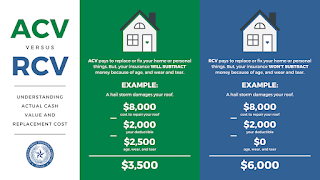

Replacement Cost vs Actual Cash Value

Replacement cost and actual cash value are two methods of valuing property in the insurance industry.

Replacement cost is the cost to replace damaged or destroyed property with new property of the same kind and quality, without deduction for depreciation. In other words, it's the amount of money it would take to completely replace a damaged or destroyed item with a brand new one of the same quality.

Actual cash value, on the other hand, is the cost to replace damaged or destroyed property with new property of similar kind and quality, less depreciation. This means that the insurance company takes into account the age and condition of the damaged or destroyed property and subtracts the depreciation from its original value.

For example, let's say a 5-year-old television was destroyed in a fire. The replacement cost of the television would be the cost of buying a new television of the same brand and quality. The actual cash value, however, would take into account the fact that the television is 5 years old and has depreciated in value, so the insurance payout would be less than the cost of a brand new television.

In general, replacement cost coverage tends to be more expensive than actual cash value coverage because it offers more comprehensive protection. However, actual cash value coverage can be a good option for those who are willing to accept a lower payout in exchange for lower premiums.

Learn more at Community Insurance Solutions LLC.

Navigating the Current Property and Casualty Insurance Market

Navigating the Current Property and Casualty Insurance Market The Property and Casualty (P&C) insurance market in 2025 is experiencing ...

-

CATASTROPHIC LOSSES A Leading Driver of Rising Property Insurance Costs When the eye of the storm wreaks havoc, many commercial properti...

-

Navigating the Current Property and Casualty Insurance Market The Property and Casualty (P&C) insurance market in 2025 is experiencing ...

-

Many people rely on their employer-provided life insurance policy as their only source of coverage. However, there are a number of reasons w...