Replacement cost and actual cash value are two methods of valuing property in the insurance industry.

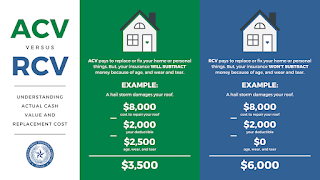

Replacement cost is the cost to replace damaged or destroyed property with new property of the same kind and quality, without deduction for depreciation. In other words, it's the amount of money it would take to completely replace a damaged or destroyed item with a brand new one of the same quality.

Actual cash value, on the other hand, is the cost to replace damaged or destroyed property with new property of similar kind and quality, less depreciation. This means that the insurance company takes into account the age and condition of the damaged or destroyed property and subtracts the depreciation from its original value.

For example, let's say a 5-year-old television was destroyed in a fire. The replacement cost of the television would be the cost of buying a new television of the same brand and quality. The actual cash value, however, would take into account the fact that the television is 5 years old and has depreciated in value, so the insurance payout would be less than the cost of a brand new television.

In general, replacement cost coverage tends to be more expensive than actual cash value coverage because it offers more comprehensive protection. However, actual cash value coverage can be a good option for those who are willing to accept a lower payout in exchange for lower premiums.

Learn more at Community Insurance Solutions LLC.

No comments:

Post a Comment